- Dental Equipment Financing

- Cafe Devices Financing

- Heavier Gadgets Money

- Commercial Gizmos Funds

- Find the right Bank with Magilla Financing

A business loan has the financial support had a need to buy an effective organization’s expenses, along with startup, operations, studio repair and you will expansion. A holder essentially need certainly to file the particular purposes of which funding before a software for a business mortgage was accepted. A products mortgage is a common brand of organization mortgage, as much companies you desire certified products to run.

Other kinds of business loans fool around with a great businesses possessions or a good company user’s private assets since security, which generally means an excellent Uniform Commercial Password (UCC) filing. But not, a products financing spends the equipment itself as the security, while the fine print you to definitely loan providers need all depends considerably into specific type of gizmos. Devices fund through the following versions:

- Dental care gizmos

- Restaurant products

- Hefty gadgets

- Commercial products

Dental Equipment Financing

Dental care equipment gets out-of-date more easily than other sorts of company equipment due to fast technological improves within the dental. The new questioned lifetime regarding dental care gadgets is therefore an important believe when considering the fresh regards to such that loan. It is especially important to avoid that loan name that lasts longer than the equipment. Banking institutions are the most suitable choice having obtaining dental care devices finance, despite the fact that have the absolute most strict borrowing standards.

Brand new questioned obsolescence off dental equipment means these funds need increased credit score. Loan providers may also need to have the entrepreneur to add bank comments, providers tax returns and private taxation statements. Like with other kinds of gizmos money, its also wise to ready yourself a business package you to definitely relates to how gizmos increases the business’s earnings. An evidence of profits for a few of one’s last three years is even a common requirements when trying to get dental care gizmos financing.

More criteria because of it type of mortgage tend to be a personal debt service publicity ratio (DSR) of at least 1.twenty five, that is your internet performing earnings (NOI) split up by the obligations characteristics. NOI ‘s the organization’s annual income without the expenses it creates from its operations. Personal debt attributes are the full of money the firm is actually to make to your payment of obligations yearly, as well as prominent and you may interest. An excellent DSR higher than 1 means the business have an optimistic cash flow, if you’re a good DSR lower than step one form the firm enjoys bad cashflow.

Cafe Devices Financing

Devices substitutes and you may improvements is actually apparently well-known events getting dinner. It gizmos is often susceptible to highest real anxieties like temperature and normal explore, and you may an ever growing restaurant might you prefer more equipment to grow its functions. Of many financial loans are offered for restaurant equipment fund, but it’s important to understand the lifetime of one’s devices before buying they, and this primarily hinges on the occasions out of procedure.

Loan providers however require an effective credit score to own cafe equipment fund, while the gizmos is the equity to your financing. Specific loan providers might require a credit history regarding 750 from an optimum rating away from 850, especially if the financial is actually a bank. Lenders may also need an entrepreneur to provide proof of earnings for 2 out of the past three years operating when applying for these types of mortgage. Just as in almost every other gadgets financing, the phrase of your own financing should be no longer than the newest equipment’s asked lifetime.

Heavier Gadgets Money

Heavier gadgets is sometimes utilized in farming, structure and you will agriculture. The wear speed about this products is very high, and is also and subject to obsolescence because of advancing technical. Lots and lots of loan providers and you will small turnaround are particularly of good use having heavier products loans, because these funds are usually important to a organization’s continued functions. A corporate can also you would like home financial support inside the conent is actually to improve farmland.

Lenders of this type out of mortgage seem to should ensure that a borrower is experienced in the market, due to the fact presented by the a track record of making a profit. A detailed business strategy may demonstrate your community systems to a lender. A good credit score is even crucial for it sorts of away from devices mortgage. Lenders of hefty gadgets money ent will create money towards organization and when the company’s team has actually experience with working that particular form of products. Brand new equipment’s certification criteria are important info to know ahead of buying heavier devices, even when the lender doesn’t need they.

payday loans in South Carolina

Commercial Gizmos Funds

Industrial products boasts products that can generate income to possess a corporate however, does not fall under other kinds. It covers commercial automobile consider more than 2.5 lots, forklifts, manufacturing machines, farm systems and you can host gadgets. New cost and you will terms and conditions into the industrial gizmos funds differ considerably, although bank will money just about 80 per cent from the fresh industrial equipment’s purchase price. This requirement means that the business have a tendency to normally want to make a downpayment of approximately 20 percent to own industrial gizmos. Specific loan providers includes doing 25 % of one’s equipment’s delicate costs in the mortgage, which includes distribution, set up, repair, and app.

Lenders normally wanted comprehensive documents having industrial devices funds, along with financial comments, team tax returns, individual tax returns and you can organization subscription. A beneficial DSR of at least step 1.twenty-five is even a common dependence on this type of mortgage. Particular financial loans will let you deduct loan repayments with the industrial products given that a functional bills, regardless of if your own CPA will need to deliver the information about which options.

Find the right Bank with Magilla Financing

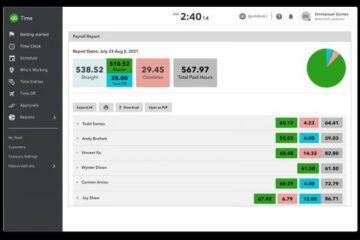

Magilla Loans connects borrowers that have loan providers for all sorts of money, plus providers gizmos loans. All of our platform lets borrowers to search and you will examine funds as opposed to bringing personal information eg identity, phone number and you may societal cover matter. The borrowed funds proposals is actually upcoming demonstrated for the the patented MagChart, that enables consumers in order to without difficulty compare financing terms. Go to Magilla Financing on the web today to find out more about the way we makes it possible to find the appropriate business equipment loan to fit your business requires.